Turn News Into Daily Profit

While you read this story, AI-Kryptonite can scan the markets and execute trades across our CryptoBlitz, Golden WealthWise, and StockBull engines.

View AI-Powered Trading PlatformsCrypto markets move faster than any human can process. Price swings happen in milliseconds. Liquidity thins out without warning. Market sentiment flips from greed to fear instantly.

This is why AI-driven systems have become essential in modern trading. They analyze market volatility before humans notice it, allowing automated engines to detect opportunities and exit risks far earlier.

Below is a breakdown of how AI reads volatility and why it does it so effectively.

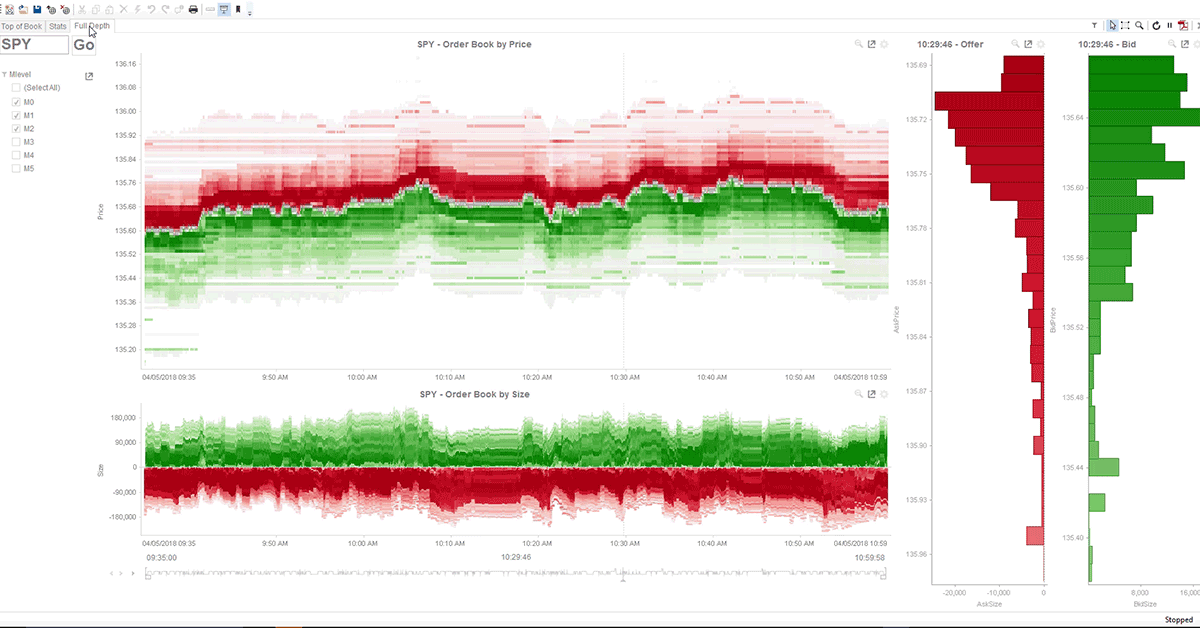

1. Real-Time Data Streaming

AI systems consume market feeds 24/7.

This includes:

-

Order book depth

-

Bid–ask spreads

-

Liquidation levels

-

Whale wallet movements

-

Funding rate changes

-

On-chain transactions

-

Exchange inflows/outflows

AI engines do not wait for candles to close.

They react to data shifts inside the candle, often predicting volatility before price action confirms it.

2. Pattern Recognition at Scale

Humans can recognize a few chart patterns at a time.

AI recognizes thousands.

These include:

-

Micro-breakouts

-

Pre-liquidation liquidity traps

-

Funding-rate-induced momentum flips

-

Momentum compression zones

-

Hidden divergence clusters

-

Whale accumulation footprints

AI doesn’t simply see the pattern. It matches it against millions of past samples and determines the probability of the same outcome repeating.

If probability exceeds a threshold, the trading engine prepares to execute.

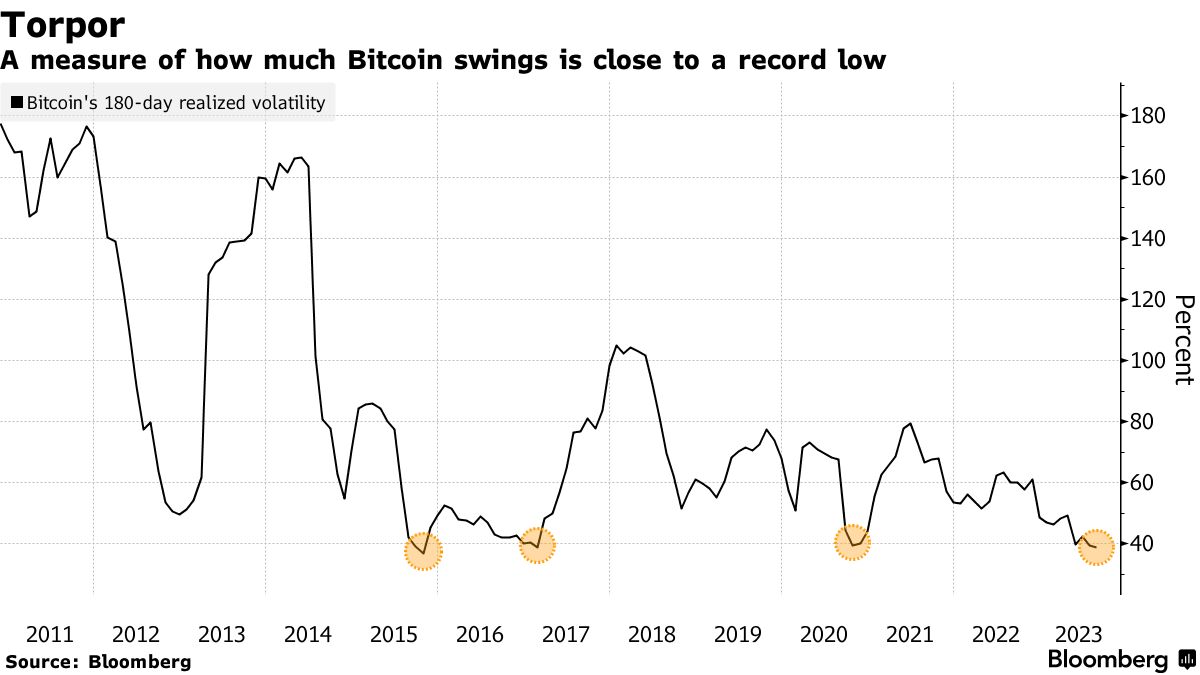

3. Volatility Clustering Detection

Crypto volatility rarely appears randomly.

It arrives in clusters—rapid bursts of movement followed by consolidation.

AI detects volatility clustering through:

-

GARCH modeling

-

Recursive variance tracking

-

Real-time ATR acceleration

-

Spread–slippage correlation analysis

When the system sees the clustering pattern forming, it can:

-

Tighten stop behavior

-

Avoid high-slippage zones

-

Trigger defensive exits

-

Wait for breakout confirmation

This often happens before the candle becomes volatile to human eyes.

4. Sentiment Intelligence: Reading What Humans Feel

AI tracks sentiment indicators such as:

-

Social media keyword spikes

-

Whale wallet activity

-

Large OTC buys

-

Exchange outflows

-

Derivatives positioning ratio

When sentiment spikes, volatility follows.

AI doesn’t wait for human emotion to show up on the chart—

it detects the emotion forming before it becomes visible.

5. Predictive Modeling With Millions of Samples

The core advantage: AI predicts movements, not reacts.

Prediction engines use:

-

LSTM neural networks

-

Gradient boosting models

-

Reinforcement learning

-

Transformer-based prediction blocks

These systems run on massive historical data:

-

Millions of candles

-

Tens of millions of order book snapshots

-

Multi-year volatility regimes

This lets AI estimate:

-

Probability of a breakout

-

Direction of volatility

-

Strength of movement

-

Duration of a volatility phase

6. Execution Before Humans Can React

The final step is execution.

AI engines execute based on probability, not emotion.

Human trader process:

See price → Think → Analyze → Decide → Execute

(Too slow)

AI process:

Data changes → Probability recalculated → Trade executed

(Several milliseconds)

This is why well-designed AI systems consistently outperform human traders during:

-

Flash crashes

-

Sudden liquidation cascades

-

FOMO breakouts

-

High-volume volatility spikes

Why This Matters for Investors

AI allows:

-

Smoother returns

-

Protected downside during chaos

-

Faster reaction to opportunities

-

Emotion-free trading

-

Consistent compounding

This is the core principle behind automated trading platforms such as AI-Kryptonite’s Sentinel engines.

Explore AI-Kryptonite’s Live Strategy Plans

To understand how each AI Sentinel reacts to volatility across different markets, review the full platform breakdown:

0 Comments

Log in to join the discussion. Sign in or create an account.